|

Robert HernandezMBA, Hablo Espanol

Private Capital Ventures, Inc. Phone: 650-776-3280 Fax 415-573-0930 NMLS :241292 Broker Lic.: 01935727 Robert@1PCVI.com www.1PCVI.com |

3 Secrets to Growing an Einstein Brain

Relativity and quantum physics weren't the only things on Albert Einstein's mind—he also had a few tricks up his sleeve for making sure his brain was both working at peak efficiency and harnessing as much of its power as possible.

Relativity and quantum physics weren't the only things on Albert Einstein's mind—he also had a few tricks up his sleeve for making sure his brain was both working at peak efficiency and harnessing as much of its power as possible. There are three parts to the brain—the stem, the limbic system, and the frontal cortex—and according to Dr. Rudolph E. Tanzi of Massachusetts General Hospital in Boston and co-author with Deepak Chopra of the book Super Brain, we get the most out of our brains when all parts in the system are working together.

Here are three exercises that when practiced regularly, can help you get the most out of your brain:

Become a possibility processor. Einstein's genius was in part due to keeping his frontal cortex (the logic center) in its place. Letting your imagination run free—allowing nonsensical, even outlandish, ideas to form without criticism or fear—can cause new neural connections to form, helping develop highly creative and refreshing ideas. The trick is not to judge these ideas too quickly; there's plenty of time to let logic sort them out later.

Look for loops. Our limbic system automatically looks for patterns and creates associations or "loops" as memory and response shortcuts. When you react to things in a way you can't quite explain, you might be stuck in a loop. Examining the source of your feelings and how your responses may have been shaped can go a long way toward rewiring unhealthy or unwanted reactions, patterns, behaviors, and more.

Reactivate all brain centers with a "S-T-O-P." Just remember the acronym STOP—STOP what you're doing; take THREE deep breaths and feel them through your whole body; OBSERVE how you feel (this activates the limbic circuit and frontal cortex); within a few seconds you can then PROCEED with full awareness of yourself and those around you.

You may not develop a new theory of relativity, but with a little practice, you'll be well on your way to discovering new mental power!

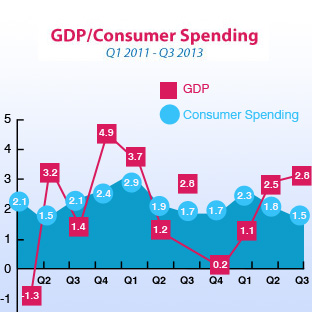

As we get ready to enter a new year, the markets are watching for signs that might indicate when the Fed will taper its Bond purchase program, known as Quantitative Easing.

As we get ready to enter a new year, the markets are watching for signs that might indicate when the Fed will taper its Bond purchase program, known as Quantitative Easing.  Although a variety of economic reports are released each month, one of the broadest measures of the U.S. economy is the Gross Domestic Product (GDP). That's why it's important to keep an eye on this report.

Although a variety of economic reports are released each month, one of the broadest measures of the U.S. economy is the Gross Domestic Product (GDP). That's why it's important to keep an eye on this report.  Here are 3 unique decorating ideas that are easy to pull off and guaranteed to add a little something extra to your winter memories—without breaking your budget.

Here are 3 unique decorating ideas that are easy to pull off and guaranteed to add a little something extra to your winter memories—without breaking your budget.  The Federal Trade Commission (FTC) estimates that as many as 9 million Americans have their identities stolen each year. This means that an identity is stolen every 3 seconds, costing the average victim nearly $4,000 and nearly 175 hours to straighten out their problems and their credit. How can you protect yourself from the dangers of identity theft? Here are some suggestions.

The Federal Trade Commission (FTC) estimates that as many as 9 million Americans have their identities stolen each year. This means that an identity is stolen every 3 seconds, costing the average victim nearly $4,000 and nearly 175 hours to straighten out their problems and their credit. How can you protect yourself from the dangers of identity theft? Here are some suggestions.  Consumers are often misled when it comes to the subject of the Federal Reserve and how it affects mortgage interest rates. Often the media is the culprit causing the confusion. Many times, the Fed has taken action that caused mortgage interest rates to move in a direction other than what consumers expected, because the media provided weak reporting on the subject.

Consumers are often misled when it comes to the subject of the Federal Reserve and how it affects mortgage interest rates. Often the media is the culprit causing the confusion. Many times, the Fed has taken action that caused mortgage interest rates to move in a direction other than what consumers expected, because the media provided weak reporting on the subject.

The

highly anticipated November Jobs Report revealed that employers created 203,000

jobs last month, above the 188,000 expected. The Unemployment Rate fell to a

5-year low of 7 percent while the Labor Force Participation Rate (LFPR) managed

to tick up to 63.0 percent, though it is still at lows not seen since the late

1970s. The LFPR is a measure of how many people are looking for work. All in all

this was a good report, but the labor market is not out of the woods yet.

The

highly anticipated November Jobs Report revealed that employers created 203,000

jobs last month, above the 188,000 expected. The Unemployment Rate fell to a

5-year low of 7 percent while the Labor Force Participation Rate (LFPR) managed

to tick up to 63.0 percent, though it is still at lows not seen since the late

1970s. The LFPR is a measure of how many people are looking for work. All in all

this was a good report, but the labor market is not out of the woods yet.

Write-offs are the government's way of rewarding taxpayers when they've done something the government likes. And to judge by the write-offs, the government likes it when people borrow money to buy a house. There are write-offs aplenty, many of which people often forget.

Write-offs are the government's way of rewarding taxpayers when they've done something the government likes. And to judge by the write-offs, the government likes it when people borrow money to buy a house. There are write-offs aplenty, many of which people often forget.